A recent article at Homeguide123 shows what median home prices would look like if the bubble never happened. Here’s the main portion of their supposition:

Historically, median home prices and median incomes have always shared a close relationship. From the mid-1970s to 2001, the historical ratio of median housing value vs. median household income was consistently between 2.6 and 3.0.

What this essentially means is that median home prices were (on average) 2.8x the median household income for the last 30 years. Using this 2.8 formula, it is very easy to estimate what median home prices would be if the most recent bubble never happened.

The results show that the median home price is 35% above this metric, and California a whopping 61%. But perhaps Walnut Creek is a bit different, right? We probably have higher incomes and then there’s the whole supply and demand equation that might skew things for the Bay Area in general and Walnut Creek homes in particular.

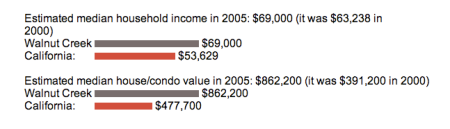

So, I dug up some information at city-data.com that shows that the bubble has clearly been felt in Walnut Creek.

So, let’s do the math. In 2000 the ratio was $391,200/$63,238 or 6.2. This is clearly more than the national average and shows the premium that we pay for living in such a great area.

However, let’s to the math for 2005. $862,200/$69,000 or 12.5! That’s double the ratio from just five years prior and I doubt highly that the numbers have changed for the better in 2006 or 2007. To put it another way, income rose 9% over the 5 year period while home values rose 120%!

I ask you, does this sound logical? Does this sound sustainable? Walnut Creek Housing Bubble? Oh yes.

Tags: contra costa real estate, housing bubble, median home value, median income, walnut creek, walnut creek home prices

March 12, 2008 at 7:03 pm |

If people can afford the house, the price won’t go down too much.

The life style is elastic, so if housing budget is 20% of your income, you will live a good life, have $40 per pound beef everyday, but if it’s 40% of your income, you can eat more ramem, buy everything in Costco rather than Macy’s or Andronico’s, so you still can live a fair life. And if Walnut creek guy earn more and pay more percentage of his income to housing, but the absolute value of income leftover is also more or comparable to those we earn less and pay less to house.

My opinion is even if the the house price is 12.5 times of median income, people here can afford it, and willing to pay it, the price won’t drop too much.

March 12, 2008 at 7:27 pm |

Ming,

Well it depends on your definition of afford. You’re right, many people can buy into a house and pay a large percentage of their income to the mortgage and property tax. Essentially they’re house poor – living in a decent house but living on Ramen and never getting to go on vacation, not to mention under-saving for retirement.

The question is why people are willing to do this? Previously it was the idea that the value of your home would appreciate and it would be an asset to rely on in the future. If things went haywire you could always sell and make a profit. That and the instant gratification of being in a nice home.

The problem is that’s no longer the case. Even if you believe housing isn’t going to fall dramatically I think you’d be hard pressed to believe it will increase much (if at all) over the next 5-7 years. So, suddenly real estate is a very normal investment, 5-10% return, instead of 100%.

So with housing flat or falling, these house poor folks aren’t spending much which is a HUGE drain on the economy. The single most important factor of our economy – consumer spending – would continue to be crippled.

People can afford it, and are willing to pay it – the question is whether that’s smart for them specifically, smart for us as homeowners and smart for us as a country/economy.

My belief is no, it’s not smart. In fact, it’s this mentality that created the subprime mess. Taking on too much in the hopes that things will turn out right is a bit reckless. We need responsible home ownership so they can save and spend, protecting both our future and current economy.

March 12, 2008 at 9:30 pm |

I disagree. Poeple cannot afford it. They have simply been living off of the equity in their homes. It seems that a whole generation of people considered the equity they borrowed against their homes as income.

To qualify for an 800,000 loan with 30,000 down you need an income of over 200,000.

The equity lines are being yanked and people are going to be in serious financial trouble in the upcoming future.

This is just my opinion and what do I know. Several of my friends are in this exact situation. They went out and bought new cars and tons of other crap that they didn’t need. When expences increased it was no propblem because they had that equity line to help them pay. I watched in amazement but didn’t say anything. Can you imagine paying your mortgage with money your borrowing out of your house??!!

Anyway they got a letter and have been cut off and this is in Marin and sorry to say but our shitboxes are worth much more that your shitboxes in walnut creek.

Without the financing and forcing people to truely qualify for mortgages is going to reduce the price of real estate. There is no more funny money.

March 12, 2008 at 9:41 pm |

Aaron,

Yes, it’s one thing to afford it when you purchase, or for a few month. But you’re absolutely right, long-term it doesn’t work out if you’re forking over that much for your mortgage AND going on a spending spree.

Paying your mortgage out of a home equity line!? Wow. Crazy. Sad part is – that’s even rosy – some don’t even have equity to tap!

People need to live within their means – and if they did housing prices would go down. Sadly, it seems like there are still people out there willing to do this. And lenders were all to happy to fan the fire by giving ‘funny money’ to these eyes-too-big-for-your-wallet crowd.

The amount of ‘funny money’ is going down dramatically, so perhaps the market will help people get the reality check they desperately need. The recent move by the Fed to buy these distressed loans back from lenders might allow ‘funny money’ to flow again.

That’s sad, and dangerous since it just delays the inevitable, both in new overburdened homeowners and the fact that the lenders will eventually have to buy the distressed loans back from the Fed.

Thanks for your comment and stay financially strong!

September 20, 2008 at 12:26 am |

“If people can afford … and are willing to pay it … prices won’t go down much”. Nothing like smokin’ that Northern California HomeGrown. But seriously dude, you just don’t get it. If you are only making $50K you can only afford $140. You can’t afford $300, $400, or $800. Let me state it another way. Noone is going to write mortgages like that anymore. Nobody. Noone. The only reason why banks didn’t go broke 10 years ago is that there were bigger idiots willing to buy the overpriced homes with to even more leveraged buyers. Many people used their homes like ATM machines. Who do you think is going to pay $800, and where do you think they will get the money? Throw in Real estate taxes, throw in insurance, throw in the fact that anything with plastic (an oil product), metal, glass, wood, etc. is going to cost more to fix things because the dollar will decrease in value as the Feds print money to pay for the housing bubble mess. Ming not read article. Ming living in time of Ming dynasty. Ming watch lot of TV. Ming for Congress!

November 20, 2009 at 8:24 pm |

Hi;

I came across this article by chance and read it with some surprise. I live in Walnut Creek and have for over 20 years.

When I bought my house the lenders used a scale of 15% to 20% of my income after taxes to determine if I could qualify for the loan. It was the same in Marin.

When I bought an investment condo here I used the old 100 times gross method to determine if it was a good value or not. Simply if the gross (before all expenses) was $1,000. per month, it was worth $100,000. $2,500 per month = $250,000.

People will always need to buy and sell homes, marriages, divorce, death, relocation, retirement and many other reasons as the live their lives. If a person loses his job and cannot afford to pay the mortgage they have to sell or the lender has to foreclose. Too many of these in any location causes the prices to decline.

You can argue the dirt is more valuable in Marin than WNC, it would be lame to argue the houses are. I think one of your crass contributors called them shitboxes.

What will determine how much housing will sell for in the future will in part be can you find a buyer who is willing to ignore the simple metrics of smart real estate investment and pay what you could have sold your real estate for in June 2007.

Sure there are buyers who will pay all cash. Some need a negative cash flow or (write-offs). Some will ignore the lack of public transportation, good jobs and increasing traffic in Marin and other Bay Area communities and pay a premium for the address. There are people who buy Jaguars and Hummers who will tell you “I don’t worry about the price of gas or continual repairs”. Because we all supposedly impressed that they can afford to waste their money.

Baby boomers have been looking forward to that $500,000. when they no longer have to fight that miserable commute. They can buy something more reasonably priced, get away from the traffic, congestion, expenses and attitude of where they live now. They may be ready to take some of their money that they have left out of Wall Street.

Do you think they are going to put it into outragiously overpriced real estate? If not, look for some young couple who are making a half million a year to buy you aging house with a great address or think about what it would rent for or how much of a pension income it would take to buy it from you.

Would you take what is left of your nest egg to buy the house across the street? Think about it.

Cheers

Jack